Building a Data-Driven Investment Strategy Framework

Research has shown that a programmatic approach to M&A has consistently generated above-average returns. A data-driven investment strategy helps you prioritize your time, make better decisions, and ultimately create outlier long-term value.

Our systematic framework ensures consistency and scalability across your entire investment process while capturing institutional knowledge for future deals.

Everyone has their own idea of what constitutes an investment strategy. While every industry has its own characteristics, and every investor has their own beliefs or preferences, we still believe there can be a standard approach to building a framework for investment strategy.

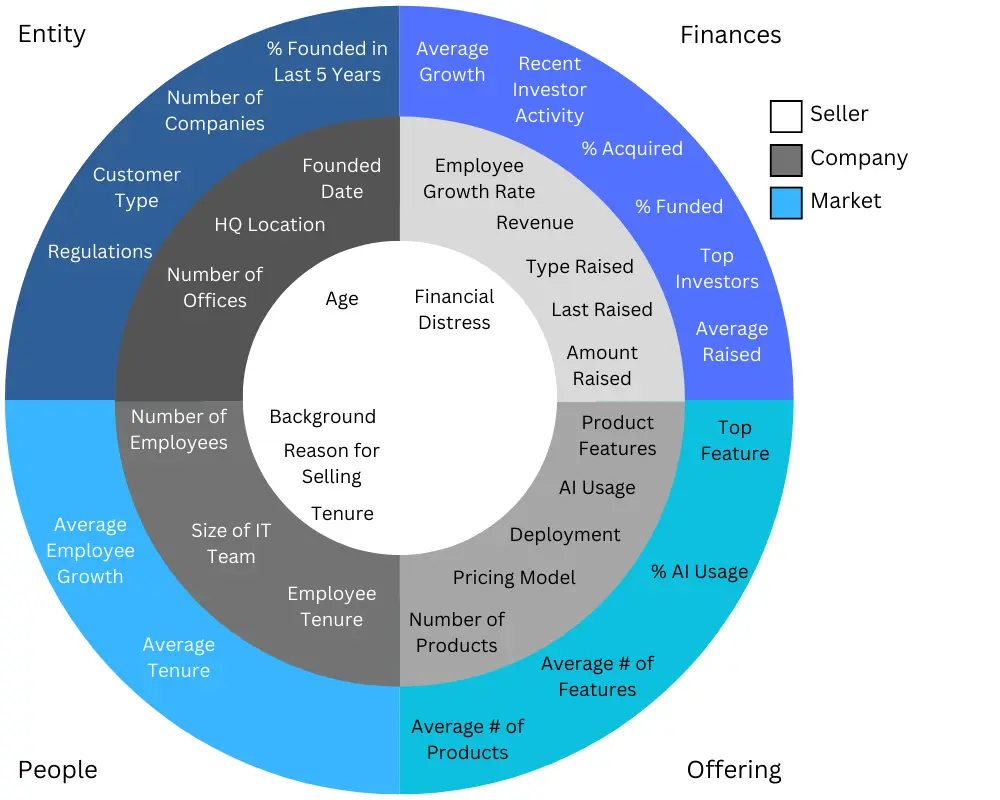

Our approach relies on a system of spheres, slices, and parameters where each sphere represents a broader category of parameters and each slice permeates multiple spheres.

Framework Assumptions

For the sake of simplicity, we'll assume that:

We are building a framework for software companies

The seller is the same as the CEO - i.e. the company is not owned by a PE fund so most decisions to sell the company are made by the CEO

The Three Spheres Framework

A systematic approach to categorizing and analyzing investment opportunities through interconnected data layers

Seller (Inner Sphere)

The seller is the inner sphere of our framework - understanding the motivations and background of decision makers.

Personal Factors:

Age

Background

Tenure

Financial Distress

Motivations:

Reason for Selling

Company (Middle Sphere)

The company sphere covers operational, financial, and product-related data points.

Entity:

Founded Date

HQ Location

Number of Offices

People:

Number of Employees

Size of IT Team

Employee Tenure

Offering:

Number of Products

Pricing Model

Deployment

Product Features

AI Usage

Finances:

Revenue

Employee Growth Rate

Last Raised

Amount Raised

Type Raised

Market (Outer Sphere)

The market sphere provides aggregated insights across all companies in the same industry.

Entity Metrics:

Number of Companies

% Founded in Last 5 Years

Customer Type

Regulations

People Metrics:

Average Employee Growth

Average Tenure

Offering Metrics:

Average # of Products

Average # of Features

Top Feature

% AI Usage

Finance Metrics:

% Acquired

% Funded

Top Investors

Average Raised

Recent Investor Activity

Average Growth

Interconnected Framework

Each sphere provides context for the others, creating a comprehensive view of investment opportunities. Data flows between spheres to inform decision-making at every level.

Getting the Data

A successful investment strategy framework requires robust data infrastructure to collect, process, and analyze information across all three spheres.

Seller Data

Networking websites (LinkedIn, industry directories)

Team interactions and relationship building

CRM integration for relationship tracking

Company Data

Website scraping and Generative AI extraction

Financial databases and SEC filings

Product demos and technical analysis

Market Data

Aggregated company data analysis

Industry reports and market research

Competitive intelligence platforms

Data Infrastructure Requirements

Implementing this framework successfully requires a centralized data warehouse that can integrate information from multiple sources and provide real-time insights across all three spheres. This infrastructure should support:

Technical Capabilities

Real-time data ingestion from multiple sources

Automated data cleaning and standardization

Generative AI for unstructured data extraction

Advanced analytics and pattern recognition

Secure data sharing across team members

Business Benefits

Consistent evaluation criteria across all deals

Institutional knowledge preservation

Faster due diligence processes

Better pattern recognition and trend analysis

Improved investment committee presentations

Framework Implementation

Our Investment Strategy services ensure you have all the relevant data and systems to empower your decision making across every stage of the investment process.

Traditional Approach

Ad-hoc data collection for each deal

Inconsistent evaluation criteria

Manual research and analysis

Knowledge lost between deals

Difficulty comparing opportunities

Verus Ventures Framework

Systematic data collection across all spheres

Standardized evaluation parameters

Automated data processing and analysis

Institutional knowledge preservation

Consistent cross-deal comparisons

The Verus Advantage

Faster Due Diligence

Better Pattern Recognition

Consistent Evaluation

Custom framework design tailored to your investment thesis

Integrated data infrastructure supporting all three spheres

Ongoing refinement based on deal outcomes and market changes

Training and support for your investment team

Seamless integration with existing deal sourcing and portfolio management systems