From CRM Chaos to Investment Intelligence

Investors tend to shudder at the sound of the word "CRM". But there is tremendous value hiding behind the sometimes tedious day-to-day tasks.

This case study showcases how a billion-dollar software investor was able to leverage a custom CRM solution to streamline their processes, significantly reduce costs, and gain unlimited insight into their M&A operations.

Sound Familiar?

"Don't forget to add that company to Salesforce!"

"Did you log your conversation in Salesforce?"

"Hey - can you update the revenue numbers for this company in Salesforce?"

"John just left the company - can you transfer all his 200 accounts to Joe?"

Whether you're part of a small PE firm of 10 employees or a multinational conglomerate, these are likely some of the realities you've had to endure. For many investors, the CRM acts as a "repository of companies" that must be painstakingly updated whenever something of value occurs.

It doesn't have to be that way.

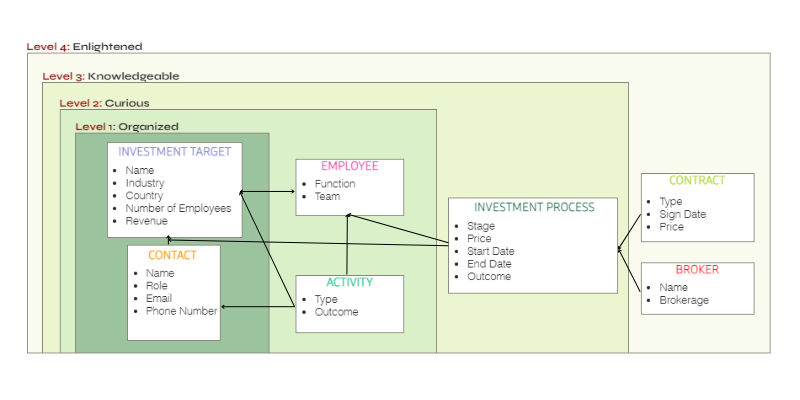

A Simple Model of an Investment Company

Our model consists of interconnected entities that perform actions with other entities. Your level of insight into your investment operations depends on how many entities/actions you have, and how interconnected and parametrized these items are in your CRM.

Investment Company Framework

Each level represents increasing sophistication in tracking and connecting entities within your CRM system

Entities

EMPLOYEES

Corporate Development or M&A individuals/teams

INVESTMENT TARGET

Companies with which you would like to hold an investment process

CONTACT

Individuals at investment targets who can provide meaningful information

BROKER

Third-party entities who may connect you with investment targets

Actions

ACTIVITIES

Emails, calls, meetings with contacts at investment targets

INVESTMENT PROCESS

The process towards obtaining a desired outcome with a target

CONTRACTS

Legal documents (NDA, IOI, LOI, Purchase Agreement) indicating progress

On the Road to Omniscience

The five levels of CRM sophistication - from basic organization to complete operational intelligence

Level 1: Organized

A Level 1 organization uses the CRM as a repository of potential investment targets and contacts for organization purposes.

Questions you can answer:

- • How many potential targets do we have in a particular industry or geography?

- • What is the size of a particular market (in employees or revenue)?

- • Who are the important people to reach out to at these targets?

- • What is fill rate of contacts (how many targets have an associated contact)?

Level 2: Curious

A Level 2 organization begins to track their corporate development processes to understand the employees and actions that lead to specific outcomes.

Questions you can answer:

- • Which types of activities are better suited for specific outcomes?

- • How many activities does it usually take before we establish a meaningful conversation?

- • Which of our employees/teams is driving meaningful conversations with investment targets?

Level 3: Knowledgeable

A Level 3 organization begins to build an understanding of their investment processes as a separate entity connected to other entities.

Questions you can answer:

- • What is our deal velocity? How well do our deals convert?

- • Where are most of our successful deals?

- • What do we usually pay for companies of a certain size in a particular industry?

- • Why are some of our processes unsuccessful?

Level 4: Enlightened

A Level 4 organization has a full understanding of their corporate development and investment processes and the internal/external drivers that lead to specific outcomes.

Questions you can answer:

- • How many activities does it take before we sign an NDA? Who is signing the most NDAs?

- • What is our offer velocity? How long does it take from NDA to IOI? IOI to LOI?

- • Who are the brokers that are inviting us into successful processes?

- • How does our offer price differ by team, industry, or geography?

Level 5: Omniscient

A Level 5 organization includes even more entities, actions, and parameters in their model. These organizations leverage automated workflows, fully track historical changes to key parameters, perform analysis on every step of their operations, and integrate additional processes into their CRM.

They truly know all there is to know.

From Level 2 to 5 in 30 Days

This case study covers the transformation of one of the largest software investors in the world. This investor leveraged a decentralized operating model with several dozen independent investment teams rolling up into a smaller number of portfolios.

The Starting Point: Level 2 Challenges

The CRM was utilized as a repository of target companies and some contact data was available

Account ownership changes were done manually - sometimes hundreds at a time

Only a small subset of activities were tracked

Contracts were tracked a separate entity but were not properly connected to employees or companies

Employees were entered as text instead of linked to the entity

Offer prices were duplicated as a separate parameter of the company rather than pulling from the contract

Some prices were in millions, others in thousands, others in dollars

Investment process reporting was completed outside of the CRM using Excel templates

The head office and board of directors received a copy every 3 months

Duplicate data entry led to consistent manual errors and blank/incorrect values

Learning opportunities were hindered by low data quality and the massive manual effort required for any sort of analysis/experiment (90% of the time was spent compiling clean data)

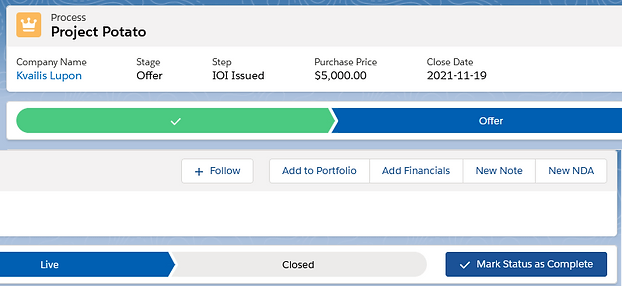

Investment Process Replication

The investment process was fully replicated in Salesforce, granting a clear image of investment operations on a daily basis.

- Fully automated pipeline reporting was available with full insight into every step of the investment process including key milestones and deal velocity.

- In-depth parametrization and connectivity between entities allowed for a complete understanding of lost processes and important market participants and trends.

- An interactive and intuitive investment process workflow was implemented to guide employees through the new operating procedures.

Interactive workflows guide users through the investment process.

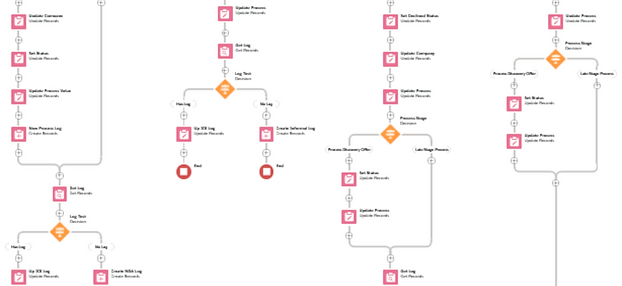

Automation and Data Governance

Gone were the days of employees using different units for the same parameter, entering incorrect data or leaving crucial parameters blank.

- Strict data validation removed manual errors, forced the population of critical data points, and restored trust in data quality.

- In-depth automation meant fields were populated automatically, historical changes were tracked for all important parameters.

- Administrative data requests were handled by a centralized support team and could be requested through a ticket system built directly into the CRM.

Automation handles repetitive tasks and ensures data quality.

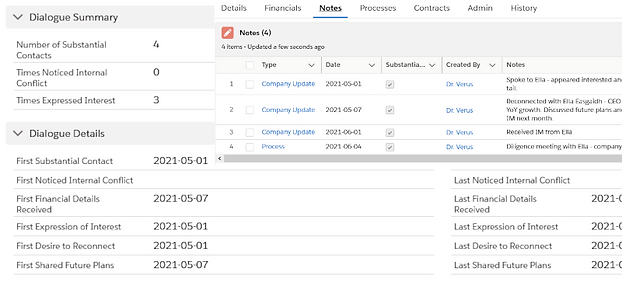

Data Model Expansion

Several new entities and actions were added to the investor's data model in order to fully capture every internal and external driver affecting their investment operations.

- Dozens of new parameters were exposed across the many entities and actions in the investor's Salesforce model, granting complete insight into every step.

- Insights and learnings became available immediately with analyses and experiments not only trivial to perform, but also easy to modify and repeat through time.

- Unlimited learning opportunities were unlocked across all investment operations.

A rich data model unlocks unlimited learning opportunities.

Transparency Makes the World Go Round

This particular investor had a relatively unique lead allocation process which caused them quite a headache.

The Old Process

Lead Allocation Rules:

- • The team that added the target obtained exclusive ownership for one year

- • After one year, if no dialogue established, account became open for contact

- • Other teams could request ownership if they established dialogue

- • Ownership changes required executive approval via email

The Headaches:

- • Backlog of requests could pile up or be lost

- • Lengthy investigations if evidence not entered in Salesforce

- • High-stress conflicts consumed hours of executive time

- • Investment targets frustrated by multiple team contacts

The New Process

Integrated Solution:

- • New "Transfer Request" entity connected to employee, activity, and investment target

- • Button on company profile to initiate transfer request

- • Required contact and activity evidence to submit for approval

- • New portfolio-level role for pre-approval before escalating to head office

The Results:

- • Full visibility into lead allocation process and its benefits/drawbacks

- • 50% less conflict between teams due to transparent process

- • Low quality requests no longer submitted

- • Significantly more data entered into Salesforce

- • Clear understanding for investment targets on which team would interact with them

Take the Time to Add a Cherry on Top

This is just the tip of the iceberg. To get the most out of your CRM experience, consider adding these advanced features:

Lead Qualification

Automatic lead qualification and prioritization algorithms

Financial Integration

Multi-year financial information and deal structures

Third-Party Enrichment

Industry growth metrics, firmographic data, contact data

Process Integration

Integration of various related processes into single workflow

Automated Reporting

Automated reports and dashboards covering every step of operations

Documentation

Built-in documentation to educate employees on best practices

For additional enhancement ideas, consider integrating data from third-party products and your first-party data sources.Learn more in our brief on the many benefits of leveraging data warehouses for investment company operations

Transform Your CRM from Chaos to Intelligence

For all this and more, consider a custom CRM solution to save time and money while unlocking unlimited insight into your investment operations.

Days to Level 5

Less Team Conflict

Time Savings on Analysis

Custom CRM design tailored to your investment processes and organizational structure

Complete automation of manual tasks and data validation to eliminate errors

Advanced reporting and analytics providing real-time insights into all operations

Seamless integration with existing data sources and third-party tools

Ongoing support and enhancements as your organization grows and evolves